Asia’s Data Center Boom – Unraveling Growth Stories

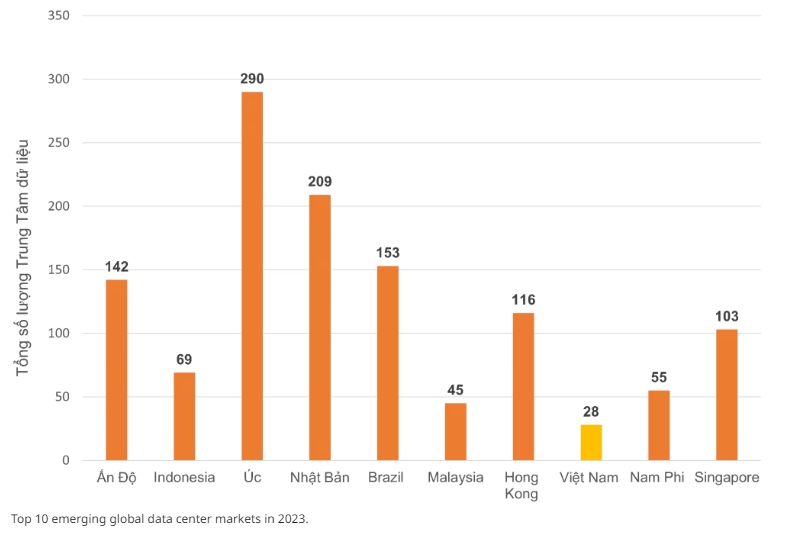

According to recent research conducted by Savills, the demand for data centers in Asian countries is on the rise, propelled by the growth of the digital economy and the increasing prevalence of online shopping habits. Notably, nations like India, Indonesia, and Malaysia are actively implementing development strategies to meet this escalating demand.

In particular, Malaysia has made significant investments in digital infrastructure, including the deployment of undersea fiber optic cables, thereby enhancing domestic connectivity and advancing 5G technology. This has attracted foreign companies, exemplified by Australian data center investor NEXTDC, currently in the process of constructing a 65MW data center in Malaysia.

In India, the total capacity of the country’s data centers is projected to increase by 150 MW in 2022 and an additional 250 MW in 2023, resulting in a cumulative capacity of 1 GW. Government-driven initiatives like Digital India, along with a focus on self-reliance and data protection through data localization, are anticipated to contribute to a surge in data volume within the country, consequently driving up the demand for data centers.

In the case of Indonesia, the appeal of data centers extends beyond serving domestic needs and is also geared towards meeting international demands. An example of this trend is evident in Batam, an Indonesian island situated near Singapore, which is anticipated to emerge as a future hotspot for data centers catering to both Indonesian and Singaporean requirements. The development on this island incorporates both conventional and renewable energy sources, making it an attractive destination for data mining operations.

According to a report from Savills Asia Pacific, Vietnam’s data center market is recognized as one of the fastest-growing globally. This growth is attributed to the digitalization efforts of domestic small and medium enterprises, a tech-savvy young population, the advent of 5G technology, the push for digital infrastructure self-sufficiency, and the implementation of data localization laws.

Records from Savills Vietnam indicate that there are a total of 28 data center projects across the country with a combined capacity of 45 MW, involving the participation of 44 service providers. Since the first quarter of 2021, there has been an increase in inquiries from foreign data center operators exploring potential locations and seeking joint venture partners. This surge in interest coincides with major hyperscalers expressing their intentions to invest in Vietnam. Notably, in August 2021, Amazon Web Services (AWS) announced the establishment of data centers in Hanoi and Ho Chi Minh City.

With the ambition to evolve into a significant digital hub, Vietnam’s data center market is projected to surge to USD 1.04 billion by 2023, marking a substantial increase from USD 561 million in 2022 and demonstrating a rapid growth rate with a compound annual growth rate of 10.7%.

However, Mr. Thomas Rooney, Senior Manager of Industrial Consulting Services at Savills Hanoi, emphasizes that such swift expansion brings along inherent risks and responsibilities. Ensuring data privacy, network security, sustainable resource consumption, and maintaining reliability and service quality are critical aspects that Vietnam needs to address. This entails grappling with the challenges and opportunities presented by cloud computing, colocation services, enterprise computing, and edge computing—all of which play pivotal roles in shaping the trajectory of the country’s digital infrastructure.

Vietnam’s Data Center Advantage – Navigating Costs, Growth, and Real Estate Opportunities in the Asia-Pacific Landscape

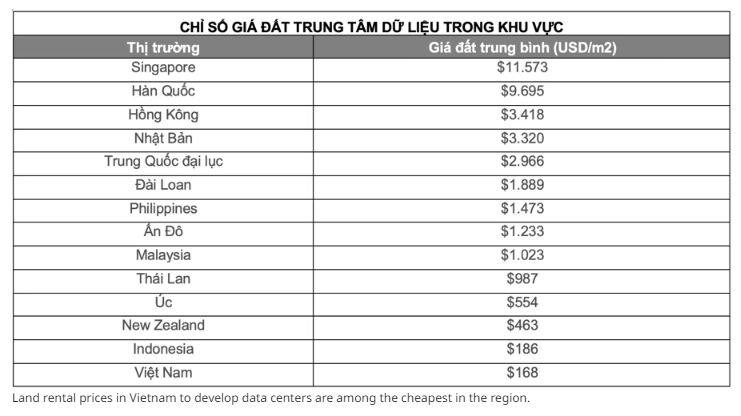

In the realm of data center project development costs for 2023/2024 across 37 cities in 14 key markets in the Asia-Pacific region, Cushman & Wakefield provided insightful statistics. Notably, five markets stood out for having the highest average land prices, namely Singapore (USD 11,573/m²), South Korea (USD 9,695/m²), Hong Kong (USD 3,418/m²), Japan (USD 3,320/m²), and Mainland China (USD 2,966/m²).

When it comes to construction costs, factors such as raw material prices, energy, and transportation costs have shown no signs of decrease, maintaining high levels. This has resulted in record-high construction costs, measured in USD per Watt. Specifically, the top five markets with the highest construction prices in the region are Japan, Singapore, Korea, Hong Kong, and Australia, all at USD 12.73/W. Singapore and Australia are experiencing typical annual cost increases of 8% and 3.5%, respectively.

In contrast, Vietnam emerges as a dominant player in rental prices, boasting the lowest average price in the region at USD 168/m² for data center projects. Additionally, construction costs in Vietnam are notably low in the Asia-Pacific region at USD 6.70/W.

Ms. Trang Bui, General Director of Cushman & Wakefield, notes that in comparison to mature markets, Vietnam’s data center market is still in its early stages, exhibiting a more modest growth rate. However, the country’s competitive construction costs, favorable land prices, and strategic geographical location make it an emerging market that consistently attracts investor attention. Specifically, Ho Chi Minh City and Hanoi currently possess 45MW of operational capacity, 16MW under construction, and the potential for an additional 40MW in the future, with a vacancy rate of 42%.

These advantages are expected to catalyze the development of the real estate industry, especially as the global search for land resources to build data centers intensifies in both emerging and developed markets across the Asia-Pacific region. Finding land with proper planning and available power sources, free from restrictive contractual conditions, and at commercially viable prices is becoming increasingly challenging in the Asia-Pacific region and around the world.

Media Contact

Universal Smart Data Center Technology

Phone: (+84) 28 73080708

Email: info@new.demo.usdc.vn